Making a Difference

Native Forward is in its fifth decade of providing scholarships for undergraduate, graduate, and professional education for Native students. When investing through Native Forward, you invest in a new generation of leaders for Indian Country.

Our students’ continuing efforts depend on your continued support. Through scholarship funding and holistic support, Native Forward has increased the graduation rates of undergraduate students to 69%, compared to the national average of 41% for Native students, and has boosted the rate for graduate students to 95%.

Create a legacy for generations to come by establishing an endowed scholarship or considering Native Forward when you plan your estate is easy to do and assures Native education continues. There are many options for named and memorial scholarships, fellowships, and internships. Gifts may include cash, appreciated securities, real estate, artwork, partnership interests, life insurance, a retirement plan, or almost any asset. For more information, contact legacy@NativeForward.org.

I really want to see more of our Native students consider education as a pathway, as a way to be an activist in their community, to empower their community and the students.

Sedelta Oosahwee | Native Forward Alumna | Mandan, Hidatsa, Arikara Nation & Cherokee

1. Become a Partner

Impact the landscape of Native Higher Education by partnering with Native Forward Scholars Fund. There are many ways in which your organization can become a partner; create a scholarship fund, establish an endowment, invest in Native Forward student support services and/or programming, or engage with us to conduct marketing and outreach to Native students to share career-focused opportunities. Sponsorship and magazine ad opportunities also exist. To learn more, contact partnerships@NativeForward.org.

2. Planned Giving

Create a legacy of empowerment at Native Forward Scholars Fund for future Native scholars by establishing a planned gift. With your intention to leave a bequest to Native Forward, you will join an exclusive group of philanthropic champions who will ensure the future success of Native Forward by empowering students with scholarships and academic support for generations to come. Learn more about planned giving options and leaving a legacy at Native Forward by contacting one of our development staff today by email at legacy@NativeForward.org.

More than half of all Americans do not have a will. When this happens, assets are distributed according to the state laws where the individual lived. Please read below for more information.

- Distribute your assets according to your wishes

- Balance your commitment to family with a desire to support a charitable organization

- Save on estate taxes with proper planning

- Build a legacy without giving up assets today

- Receive a current income tax deduction

- Reduce your potential estate taxes in the future

- Determine the exact amount of your desired support

- Experience the joy of giving today

Your first step would be to ensure you have an up-to-date will (or living trust) that reflects your charitable objectives. If you do not, you would need to contact your financial advisor, attorney, or accountant and request assistance in establishing a charitable gift. A well-defined estate plan will ensure that your wishes are respected.

In addition to cash, consider the following planned gift options:

Bequest

A bequest designates Native Forward as the recipient of a gift from your will or trust. You can select a particular program, or scholarship at Native Forward that is important to you to benefit from your gift. A bequest creates a charitable family legacy at Native Forward for generations to come. It’s easy to create a bequest; let your attorney know you would like to include Native Forward Scholars Fund in your will or trust.

Three ways to allocate a bequest:

A specific amount of cash (e.g., $10,000);

A percentage of the donor’s total estate (e.g., 10% of an estate of $1 million would be $100,000 to charity); or

The remaining value of the estate after all other bequests have been paid.

Bequests are a great option for everyone as they don’t cost a donor anything during their lifetime.

Retirement Plans and Life Insurance

You can designate Native Forward Scholars Fund as the beneficiary of a retirement plan, Individual Retirement Account (IRA), life insurance policy, or insurance annuity. While every circumstance is unique, there can often be tax advantages to selecting Native Forward as the beneficiary of a retirement plan or life insurance policy. Beneficiary forms govern the distribution of assets from these accounts. If you choose to designate Native Forward as a beneficiary, contact your plan administrator to update your forms.

Charitable Remainder Trust

A charitable remainder trust can provide a steady stream of income for the term of years that you decide. What remains at the end of the term will go to Native Forward to create a lasting legacy that fulfills your charitable giving goals, such as student scholarships. You fund the trust with a gift of cash or property, receive an income tax deduction and receive a variable or fixed amount income for the length of the term. You may also name a charitable remainder trust as the beneficiary of an Individual Retirement Account (IRA) at your death as another way to support Native Forward.

IRA to Charity

If you’ve reached the age of 70 ½ and have an IRA, you may transfer up to $100,000 annually to support Native Forward without having to claim the money as income. A gift from your IRA can be beneficial if you do not itemize your tax returns, or if you do not need the money and would move into a higher tax bracket if you take the required minimum distribution. By making a gift to Native Forward from your IRA, you can also save your heirs from heavily taxed IRA assets.

Real Estate

You can gift real estate to a Native Forward, removing a large taxable asset from your estate and receiving the benefit of an income tax deduction equal to the appraised fair market value of the property, with no capital gains tax due on the transfer. The nonprofit can then either sell the real estate or keep it for its own use.

Personal Property

We are talking about gifts of items such as artwork, collectibles, books, equipment, or other items of tangible personal property. In many cases, the gift can yield the donor a charitable deduction for the items’ fair market value. Depending on the claimed value, it may be necessary to obtain a “qualified appraisal.”

The types of planned gifts that protect a donor’s assets

Sometimes donors don’t want to give up their assets completely when making a gift. In these circumstances, there are a couple of ways for you to give while still having a significant impact.

Charitable Lead Trusts

When you make a gift through a charitable lead trust, Native Forward receives a fixed income stream. Lead trusts are the opposite of a charitable remainder trust. However, they are also fixed to a specific term length or the donor’s lifetime. When the term ends, the assets return to you or your beneficiaries instead of the nonprofit. Lead trusts are an excellent way for Native Forward to diversify our funding channels and ensure we have a set amount coming in each year.

For donors, charitable lead trusts can reduce estate taxes, while still transferring wealth to their heirs. Because the primary benefit is reducing estate taxes, these planned gifts are best for wealthy donors with significant estates.

Retained Life Estates

With retained life estates, a donor transfers a property deed or title to a nonprofit while retaining the right to use the property. Unlike a charitable lead trust where the asset returns to the donor, retained life estates belong to the nonprofit after the set term is up. At that point, the nonprofit can sell or keep the property for its own use.

This type of planned gift is great for donors who want to simplify their estate settlement process and reduce estate taxes. Like most planned gifts, they can also receive an income tax deduction for the property’s value.

Please call Native Forward at 1-800-628-1920 to discuss the process and how our development staff can assist you.

If you have already arranged for a bequest or other planned gifts for Native Forward Scholars Fund, please let us know. We would like to honor your support in transforming the lives of future Native scholars.

3. Sponsorships

Native Forward Scholars Fund host a wide range of events annually, as well as occasional special events. From graduation to campus visits to our signature leadership program, Indigenous Leadership Summit – sponsorships are available. Contact our development team at partnerships@NativeForward.org to learn more about upcoming events and how your organization can get involved.

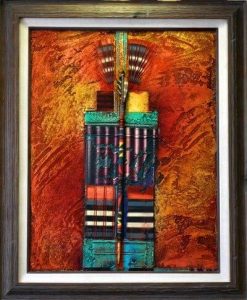

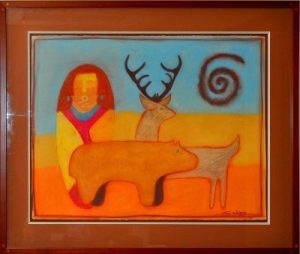

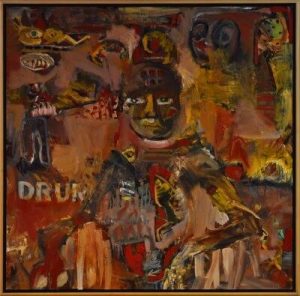

4. Purchase Fine Art

Fine Art for Sale

Native Forward Scholars Fund has a collection of donated fine art for sale. Proceeds go toward providing scholarships. Many of the pieces have been donated by Stetson Law Offices, P.C. of Albuquerque, New Mexico. Thank you to all artists and donors for their generous donations.

If you are interested in purchasing any of the art pieces or, if you would like to donate art to Native Forward Scholars Fund, contact us at 1-800-628-1920.

5. Create a Scholarship

Create a scholarship that will support more Native students pursuing college, graduate, and professional degrees. Contact donations@NativeForward.org.

6. Donate to a Specific Scholarship area

Donate to a specific funding area of interest to you. Contact donations@NativeForward.org.

Areas of interest:

STEM – Undergraduate and Graduate Degrees (including medicine)

Finance and Business – Undergraduate and Graduate Degrees

Social Sciences and Education – Undergraduate and Graduate Degrees

Fine Arts and Humanities – Undergraduate and Graduate Degrees

Climate Change and Conservation – Undergraduate and Graduate Degrees